In trading, money or risk management is very important. You need to be able to stay longer in the market in order to recover from a series of losses (trading drawdown). This is the most common mistakes of newbie traders. Here I will show you some examples how you can control your risk.

1. Percent Risk Method - In this method you risk only certain percentage per any given trade. Recommended is between 2% to 5% risk. But not more than 5%. Basically you adjust your position base on the recommended percentage every time you take a new trade in the market. Lets take a look at the example below. It will take you around 15 losing trades to half your overall capital on cases you acquire a series of losing trades.

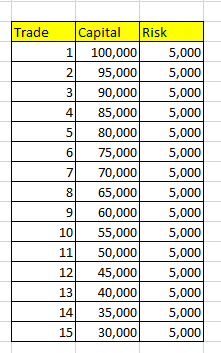

2. Fixed Amount Method - This is similar to the fixed percent risk method. The only difference is that you reduce your trading risk by fix amount. Lets say for this case P5,000 risk per trade. This is 5% of a 100K capital. On this case it will take you around 12 losing trades to half your trading capital.

3. Portfolio Diversification - This is another method commonly use to reduce the risk by distributing your capital to 3 or more companies. Beware though of over diversification because it will make it very hard to monitor your investments. In my opinion good diversification that can already track the overall performance of the market is around 3 to 5 companies. But this depends also on ones capabilities.

4. Time Diversification - The last method is about dividing your capital into parts. Lets say you have a P100K capital. You can divide it from 5 to 10 equal parts, then buy a particular company at a predetermine interval lets say once or twice a month. The purpose of this one is to be able to readjust your initial investment on cases you made a mistake on entering too early. This is similar to Peso Cost Averaging method. Which can be applied together with Portfolio Diversification.

Summary:

What ever method you choose, the point is do not risk all your hard earn money at the same time. It is best to have a trading plan and minimize our greed by practicing some good risk management methods.

No comments:

Post a Comment